Chinese entrepreneur prosecuted for fraud invests $30 million in Trump’s crypto project

A sudden $30 million injection into Donald Trump’s nascent cryptocurrency project from a Chinese billionaire being sued by the Securities and Exchange Commission for allegedly defrauding investors could potentially net an eight-figure salary for one company associated with the president-elect.

The investment sparked new concerns about Trump’s ability to potentially take advantage of foreign investors and his stances on cryptocurrencies following a presidential campaign in which he pledged to make U.S. United “the crypto capital of the planet”.

Justin Sun – a cryptocurrency billionaire famous in part for his purchase of a $6 Million Banana Artwork last month – announced his $30 million investment in Trump-backed World Liberty Financial last week, making him the company’s largest investor.

The influx of cash also triggered a provision that allows a Trump-affiliated entity to receive 75% of the company’s net revenue, based on terms outlined in a recent company filing.

DT Marks DEFI LLC, a Trump-affiliated company, is expected to make a profit of more than $15 million following Sun’s investment, renewing concerns about potential influence on Trump’s cryptocurrency positions and in the future of the SEC’s lawsuit against Sun and its companies for alleged violations of the securities laws. Sun and its companies have denied any wrongdoing.

“It’s hard to have more influence when you’re talking about money in politics than someone who just straight up gave you eight figures,” said Jordan Libowitz, vice president of the progressive watchdog group Citizens for Responsibility and Ethics in Washington.

The investment comes as Trump recently announced a series of pro-crypto nominees for his administration, including veteran regulator and cryptocurrency advocate Paul Atkins to lead the Securities and Exchange Commission, and Silicon venture capitalist Valley, David Sachs, to be the White House AI and crypto czar.

Trump has denied all allegations that he profited from the presidency.

Republican presidential candidate, former President Donald Trump at the Dort Financial Center on September 17, 2024 in Flint, Michigan.

Scott Olson/Getty Images

“President Trump walked away from his multibillion-dollar real estate empire to run for office and gave up his government salary,” Trump-Vance transition spokeswoman Karoline Leavitt said in a statement at ABC News. “Unlike most politicians, President Trump did not enter politics for profit. He fights because he loves the people of this country and wants to make America great again.”

World Liberty Financial and Justin Sun did not respond to requests for comment.

“We must be number 1”

Despite once calling cryptocurrency a “scam,” Trump in September threw his support behind World Liberty Financial, a decentralized finance platform that could eventually become a marketplace for borrowing and lending various cryptocurrencies.

“We have to be No. 1,” Trump said during the announcement, regarding the United States’ position in the crypto market. “I think AI is really important, but I think cryptography is one of the things we need to do”

World Liberty Financial currently makes money through token sales, which gives investors a say in the governance of the company; however, tokens do not offer a share of company revenue and cannot be resold.

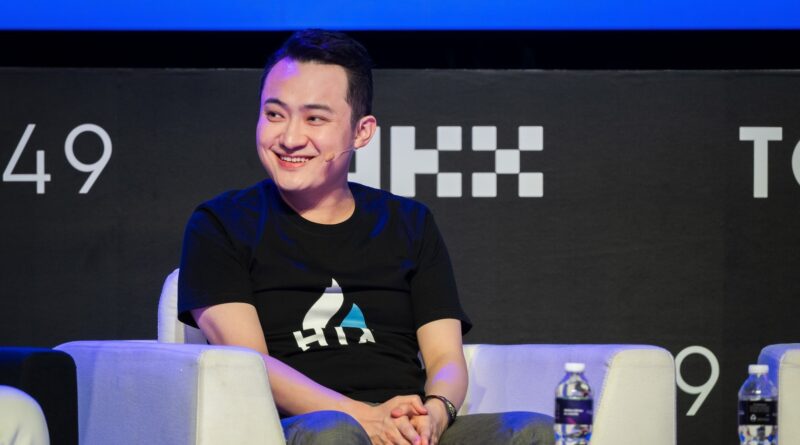

Justin Sun, founder of Tron, at the Token2049 conference in Singapore, September 14, 2023.

Joseph Nair/Bloomberg via Getty Images, FILE

Trump is neither an officer nor an employee of the company, but DT Marks DEFI LLC receives a large portion of World Liberty Financial’s revenue if the company is successful, leading some ethics experts to express concerns about that the company could be a vehicle to direct funds to Trump. .

“To call this an ethical problem is to underestimate how fundamentally corrupt it is,” said Robert Weissman, co-chair of the consumer advocacy group Public Citizen. “They set up a way for people to funnel money to Donald Trump, and now it’s done.”

Two months after its launch, the company has failed to gain much traction in the cryptocurrency space after facing criticism over its ambiguous business plan beyond its association with Trump. According to James Butterfill, head of research at asset management firm CoinShares, the company’s early marketing materials offered little more than “buzzwords.”

The weak launch also suggested that its founders and the Trumps would make little or no money from the venture. Because World Liberty Financial had made less than $30 million in revenue before Sun’s investment, any money raised by the company would be kept in a reserve to cover operating expenses while the Trumps would earn nothing, according to the terms of the company’s contract. called “gold foil“.

Enter Justin Sun, the eclectic cryptocurrency billionaire who — before spending millions on a banana stuck to the wall — made headlines for spending more than half a million dollars on a NTF of a pet rockand $4.5 million for lunch with Warren Buffet.

His $30 million investment through Tron – the popular cryptocurrency he founded in 2017 – made him the project’s largest investor and fueled a surge of interest in the once-struggling platform.

“The United States is becoming the blockchain hub, and Bitcoin owes it to @realDonaldTrump!” Sun wrote on X to announce his investment.

‘You would like to run away’

Last year, the SEC sued Sun and his companies for securities fraud for allegedly manipulating the value of a cryptocurrency and paying celebrities, including Lindsey Lohan, Ne-Yo and Jake Paul, to promote the assets without revealing that they had been paid. Sun and his companies denied any wrongdoing, and the celebrities settled the matter without admitting or denying the allegations.

Tron and other cryptocurrencies have also been criticized for allegedly allowing criminals to conduct financial transactions undetected, with a report from the United Nations Office on Drugs and Crime calling Tron a “preferred choice for crypto money launderers in the East and Southeast.” Tron executives called the report’s allegations “inaccurate” and said they “support the UN’s stance against bad actors in the blockchain space.”

Following its $30 million investment, World Liberty Financial appointed Sun as an advisor, saying his “insights and experience will be instrumental” to the company’s growth.

Weissman told ABC News he was concerned about the arrangement.

“That’s exactly the kind of number you’d want to run away from if you were starting a company, and instead they’re adopting it,” Weissman said of World Liberty Financial and Sun.

The investment could prove lucrative for Sun, given Trump’s association with the project and the number of cryptocurrencies that rallied after the election. Shares of leading cryptocurrency Bitcoin topped $100,000 for the first time on Thursday.

“With a lot of crypto, having good PR or a good type of voice helps a lot to get something noticed, and there’s no better time for World Liberty Financial,” Butterfill said. “The lines between this private company and Trump’s PR are pretty blurry, and the kind of people who run World Liberty Financial will probably play into that a little bit.”

Trump’s name and likeness are visible on World Liberty Financial’s website and marketing materials, and Trump himself is listed as the company’s “leading crypto advocate”, although the company reveals that neither Trump nor members of his family are executives of the company. According to the company, World Liberty Financial is “inspired” by Trump and hopes to introduce the platform “to a broader audience who may have been unfamiliar with or previously hesitant to engage with decentralized assets and cryptocurrency.” .

“They’re trying to take advantage of President-elect Trump’s popularity and the fact that he just won an election, to see if they can get this business off the ground and get it off the ground,” said Scott Amey, general counsel for the monitoring body. Government Oversight Project.

“Money in the hands of the future president”

Although Sun and Trump have never met, several ethics experts ABC News spoke with also raised concerns that the investment — and Trump’s possible profits — could influence the Trump’s policy towards cryptocurrencies, especially if the Securities and Exchange Commission continues to pursue its aggressive moves. litigation brought under the Biden administration.

“If you’re facing charges from the SEC, it’s a very good investment to put money in the hands of the future president to influence who might end up making those decisions at the SEC.” , Libowitz said.

Steve Witkoff, a longtime Trump friend who with his sons is co-founder of World Liberty Financial, told ABC’s “Good Morning America” in September that Trump’s foray in crypto would not pose a conflict because he would likely place his assets in a trust — as Trump did during his first administration when he placed his assets in a revocable trust controlled by his sons and an associate.

But this arrangement would not fully address concerns about conflicts arising from Trump’s crypto project, according to several experts. Trump is still able to comprehensively understand the condition of his assets, he can still profit from them and he has the power to regain control of his assets, which limits the trust’s effectiveness in preventing conflicts, several said. experts.

“In the absence of divestment and complete abandonment of these investments, he will still be able to profit from them,” Amey said.